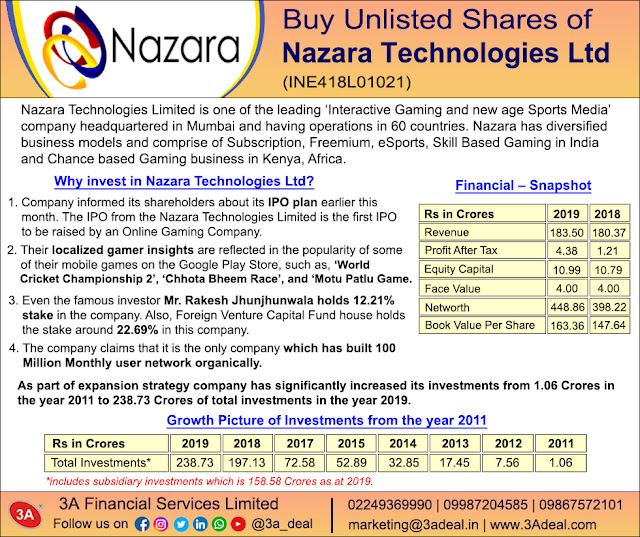

Global gaming and media sports company Nazara Technologies has filed a draft red herring prospectus (DRHP) on January 14 with market regulator Securities and Exchange Board of India (SEBI) for its initial public offering (IPO).

The veteran

investor Rakesh Jhunjhunwala-backed company had earlier received approval from

SEBI for its initial public offering in April 2018. However, it was yet to file

its DRHP.

The IPO will

make Nazara the first Indian gaming company to enlist in the market. As per the

DRHP filed by Nazara, the company will offer 49,65,476 equity shares for

sale by promoters and investors with a face value of Rs 4.

At the beginning

of January, financial and wealth advisor Plutus Wealth Management LLP

had bought shares

in Nazara worth Rs

500 crore from WestBridge Capital.

Founded in 2000

by Nitish Mittersain, Nazara has asserted itself in the interactive gaming and

sports sector through investments and acquisitions in various gaming categories

including esports, edutainment, infotainment, fantasy sports, multiplayer games

like carrom and mobile cricket games, etc. Over the last two decades, Nazara has

also expanded globally to 74 countries across Asia, Africa and the Middle

East.

In 2019, Nazara

had invested in PaperBoat App,

Absolute Sports, Crimzocode Education Private limited and fantasy sports

platform Halaplay Technologies.

In 2020, the gaming and sports company became a majority stakeholder in PaperBoat App and Halaplay Technologies.